From Fear of Finance to Financial Mastery

- Many EMBA students do not feel ready to make strong financial decisions for their organizations.

- Workshops and simulations can expose EMBA students to financial decision-making, boosting their understanding and ability to apply financial concepts.

- After taking part in a hands-on simulation at the University of California, Berkeley, students said they felt more assured about their financial mastery and had a deeper understanding of how business functions interconnect.

Just because executive MBA students enter their degree programs with years of professional experience doesn’t mean that all of them are confident in their abilities to communicate, collaborate, make decisions, and build teams. Moreover, they also often share another concern: a fear of finance.

In reality, too many EMBA students lack substantial professional experience in this discipline. As a result, they can be unsure about their financial literacy and need more help understanding and applying financial concepts.

Business schools can address their uncertainty through experiential learning opportunities that target finance—particularly via business simulations. When students have opportunities to apply their classroom knowledge to realistic situations, they can both overcome their fear of finance and prepare to make better decisions in the workplace.

Learning to Make the Business Case

There are several simulations available that specifically target finance. Celemi, for instance, has two simulations dedicated to teaching financial concepts: Apples & Oranges and DecisionBase. Another simulation, Capstone, is well-known in EMBA programs, although the focus is more on helping students apply what has been learned than on helping them build foundational knowledge.

Another simulation, Income|Outcome, was first developed 30 years ago for corporate settings. Today, it is used by many EMBA programs to immerse students in financial decision-making and help them grasp key financial concepts, while they simultaneously experience the challenges of achieving team cohesion.

When students can directly link their classroom experiences to measurable business outcomes, they can see the tangible return on their educational investment.

Income|Outcome allows EMBA students to practice working through financial problems and using different financial concepts. With practice, they develop skills that they can apply immediately to analyze costs, identify opportunities for savings, and present viable solutions for their organizations.

For example, shortly after participating in an Income|Outcome simulation at Purdue University, one student recognized that, with minor adjustments, the pharmaceutical company where he worked could save costs in its manufacturing process by switching from a larger, more expensive component to a smaller, more cost-effective alternative.

The student now possessed the tools he needed to analyze costs, quantify savings, and present a compelling case to secure the buy-in of the finance team. He took the proposal to the company’s finance team, which approved it immediately. The result? The company realized 4 million USD in annual savings.

When students can directly link their classroom experiences to measurable business outcomes at their organizations, they can see the tangible return on their educational investment.

The Workshop’s Format

The Income|Outcome simulation is used during the opening residency of the EMBA program at the Haas School of Business at the University of California, Berkeley. This initial residency serves as a critical time for students to form teams, establish a shared understanding of business concepts, and begin building relationships that will support their learning throughout the program. A mandatory part of the residency, the simulation is the basis of a four-hour, in-person workshop that aims to immerse students in strategic financial decision-making right from the start.

Students are divided into 12 teams, each managing its own business on a dedicated game board. Starting with the same initial investment, teams compete to achieve the highest retained earnings, driven by strategic decision-making and sound financial management. Along the way, participants engage deeply with key financial concepts, including income statements, balance sheets, cost structures, cash flow forecasts, and key financial ratios

Teams have the opportunity to differentiate themselves by focusing on distinct business strategies—some prioritize cost-cutting, others targete quality improvements, while others hone operational efficiencies. These decisions do not just influence their own company’s outcomes; they also affect their competitors, reflecting the interconnected nature of real-world markets.

In this hands-on, competitive environment, students must make strategic decisions that influence the cash flow, market position, and the overall financial health of their simulated companies. They must make these decisions all while navigating shifting market conditions, managing financial risks, and adjusting their strategies based on real-time results.

The workshop’s interactive format helps students experience the pressures and ripple effects of their decisions in real time, mirroring real-world business challenges. Facilitators also guide students through practical exercises that link financial statements to business strategy, providing context and immediate application for the financial concepts they are learning.

The simulation concludes with a debrief session, where participants reflect on their decision-making processes, explore the broader implications of their strategies, and consider how these insights could be applied back to their own organizations. This experiential approach not only strengthens students’ financial fluency, but also equips them with the strategic insight required for high-level decision-making throughout their EMBA journeys.

From Fear and Uncertainty…

In July 2024, a survey was conducted of approximately 70 EMBA students at Berkeley Haas before and after they completed the Income|Outcome workshop. The objective was to measure what positive effect deploying finance simulations has on EMBA students. Together, the two surveys measured shifts in students’ financial mastery, leadership development, and collaboration skills.

Most of the survey questions focused on measuring students’ confidence with specific financial concepts such as retained earnings, working capital, and direct costs. Given that leaders understand and apply these ideas to navigate business strategy, participants’ comfort with these concepts was a concrete indicator of their financial literacy and ability to make strong financial decisions.

Students’ confidence with financial concepts such as retained earnings, working capital, and direct costs was a concrete indicator of their financial literacy.

According to pre-workshop surveys, participants expressed initial uncertainty regarding their business and financial skills. In fact, of the students surveyed, 77 percent felt that their skills were “in need of refreshing,” and only 1 percent considered their skills “very strong.”

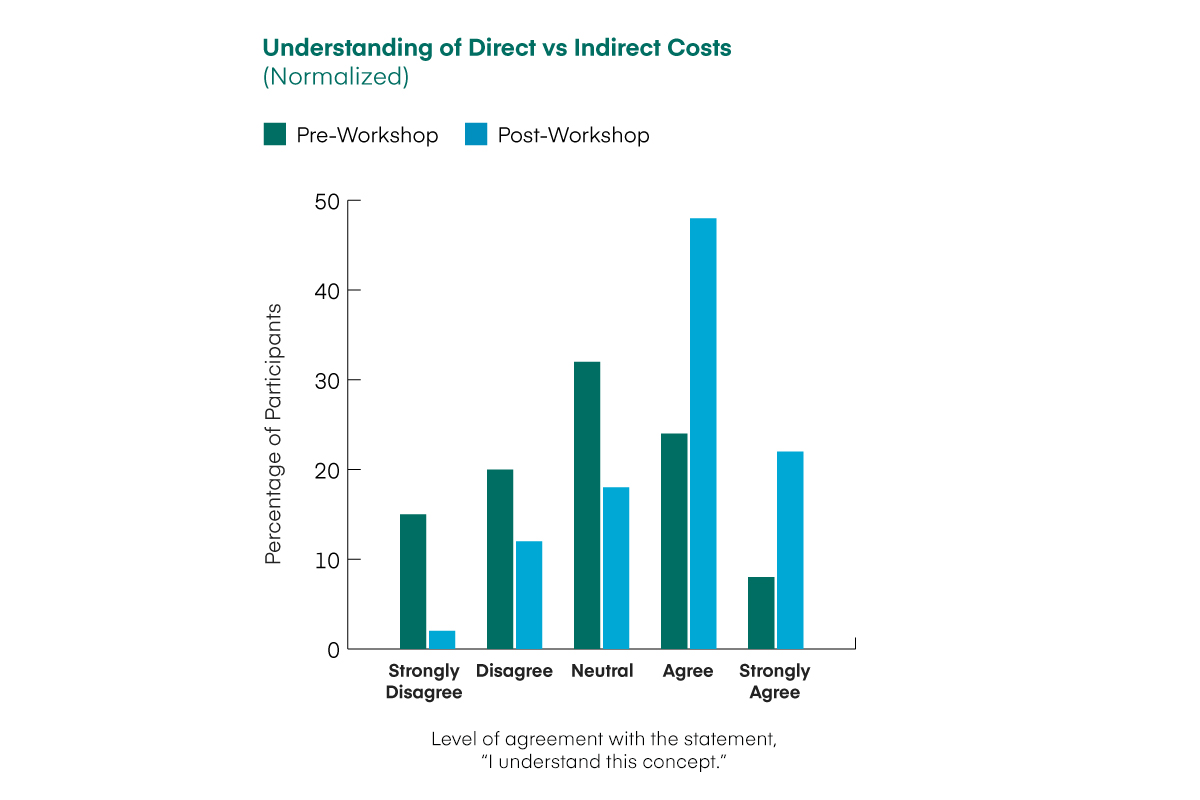

Meanwhile, 60 percent were uncomfortable interpreting financial statements and key concepts such as retained earnings, while 33 percent were unsure of their ability to explain direct versus indirect costs.

…To Comfort and Confidence…

Post-workshop surveys indicated that many of the EMBAs saw their confidence levels in their financial skills increase significantly. For instance, after completing the simulation, only 45 percent still felt their skills needed refreshing and 51 percent now rated their skills as “on par,” while 4 percent now felt their skills were “very strong.”

Moreover, 56 percent of participants now felt confident interpreting financial statements, while only 6 percent felt uncomfortable in this area. The percentage of participants who said they understood the concept of direct costs increased from 33 percent pre-workshop to 68 percent post-workshop.

The simulation’s team-based structure also encouraged participants to work together, reflecting real-world business challenges. Faculty wanted students to realize that only when team members share a common language, particularly regarding financial concepts, can they communicate effectively across functions.

This common ground allowed teams to bridge gaps between different departments, reduce misunderstandings, foster stronger collaboration, and align team members to work toward shared business goals. Together, these abilities allowed participants to make clearer decisions more quickly.

…To an Appreciation for Collaboration

In the simulation, it’s the teams—not individuals—that make key decisions in roles such as sales, marketing, production, finance, and management. Success depends on the team members’ ability to agree on critical decisions: which customers to target, what prices to set, which operational improvements to prioritize, and how to manage cash flow effectively. Each decision requires clear communication across different interconnected business functions, from multiple perspectives.

As they complete the activity, students must adapt to dynamic market conditions, all while managing the pressures of real-time decision-making. In that process, they come to realize, for example, that setting a pricing strategy requires more than just sales projections—it demands an understanding of production costs, competitor behavior, market demand, and the cash flow requirements of the business. Similarly, they see that investment decisions require team consensus on priorities: Should the company focus on cutting costs, improving product quality, or expanding capacity?

During the post-simulation debrief at the July 2024 Berkeley Haas workshop, facilitators encouraged participants to analyze their teams’ decision-making processes, identify communication gaps, and reflect on how collaboration—or its absence—affected outcomes.

In post-workshop surveys, 96 percent of participants agreed that the workshop helped them strengthen team cohesion and camaraderie. In addition, 92 percent said that the workshop enhanced their ability to collaborate effectively.

Another survey question asked participants about their understanding of business dynamics. In response, 87 percent said that they believed their understanding of how business pieces fit together had improved post-workshop.

In other words, participants not only gained financial knowledge, but also learned to see the bigger picture of how businesses operate, which is vital for strategic leadership.

Early Evidence of ROI

Overall, the survey results suggest that participants saw improvements in their financial understanding, collaborative effectiveness, and practical business decision-making. Participants left the workshop with increased confidence in financial concepts, stronger team-based problem-solving skills, and a clearer grasp of business dynamics.

These survey results also indicate that participants left the workshop believing that they had significantly enhanced their leadership skills. That perception will only strengthen their confidence that their EMBA investment will result in personal growth, and that they will be able to contribute to their organizations in ways that have measurable results.

When EMBA students boost their financial confidence, improve their ability to work in teams, and increase their holistic understanding of how businesses operate, they gain the critical components of leadership they’ll need for career advancement.

Ultimately, such outcomes don’t just show the value of providing EMBA students with experiential learning opportunities designed to bolster their financial confidence and leadership skills. They also demonstrate the ROI that EMBA participants seek from their degree programs.