Finding a Niche as Big MBA Programs Get Bigger

Sponsored Content

- To achieve future growth, all schools must align their institutional strategies with individual trends in their regional markets.

- Institutions with online MBA programs were more likely to have experienced growth than those without online MBA programs.

- An analysis of AACSB data shows that MBA programs with the largest enrollments were most likely to experience growth during the pandemic.

Enrollment uncertainty. Intensifying competition. A steady flow of new online and hybrid programs to the market. The pandemic accelerated these trends and turned just about everything in higher education upside down. Now, as the pandemic simultaneously wanes and wears on, it has never been more important for business school administrators to keep a finger on the pulse of the dynamic, ever-changing graduate program market.

Yet, amid the chaos and challenge of recent enrollment cycles, a glimmer of hope has emerged: Even during the pandemic, graduate program enrollments at many institutions have showed promising growth.

Everspring wanted to understand these trends, so that it could uncover ways a graduate program’s size and scale might impact its growth potential. We were especially interested in the impact on the most common and widely offered graduate business program: the MBA. By analyzing AACSB data and conducting qualitative interviews, we examined the graduate program market through the MBA lens.

The Impact of COVID-19 on Graduate Education

It is impossible to talk about the current landscape of the MBA market without acknowledging the impact the COVID-19 pandemic has had on the graduate degree program market overall. The pandemic exacted high tolls on enrollments of undergraduate students and graduate-level international students. However, amidst widespread decline in some areas, domestic graduate student enrollments grew.

Before COVID, many graduate-level business programs were more commonly delivered online, particularly in comparison to their in-person undergraduate counterparts. By having already developed online learning capabilities, experienced practitioners of online education were a step ahead going into the pandemic. As COVID forced instructors teaching programs at all levels to make the sudden switch to remote learning, many graduate programs were uniquely positioned to help their institutions share valuable institutional knowledge and tools.

In this context, we developed insights intended to help academic administrators and other stakeholders in higher education examine, perhaps for the first time, the impact COVID has had on their enrollments at both the program and institutional levels.

Our analysis focused on a representative sample of 295 institutions that reported to AACSB five years of program-level enrollment data for their MBA program portfolios. Some schools in the sample had a single MBA program, while others offered specialized MBA degrees and concentrations. More than 80 percent of these schools offered MBAs in either hybrid or fully remote formats, and nearly all were AACSB-accredited.

A Fluid Enrollment Environment

As we know, MBAs come in many shapes and sizes. Drawing from a wide market of potential applicants, MBA programs are industry-agnostic and teach a set of skills applicable to a broad range of careers. Some programs enroll thousands of students annually and continue to grow their enrollments; others consistently enroll fewer than 100 students each year and struggle to maintain any gains.

To compete in such a diverse market, many graduate business program portfolios have adapted and diversified curriculum and programmatic elements to provide more students more options, either through industry-specific MBAs or other specialized degree and nondegree offerings.

In September 2021, research and advisory firm Eduventures released its analysis of data from the U.S.-based Integrated Postsecondary Education Data System (IPEDS), which tracks program completions. Its findings indicate that there has been explosive growth in the number of degrees conferred by graduate business programs focused on management sciences, analytics, and quantitative methods. However, the number of degrees conferred by MBA programs has declined in recent years, dropping from 127,000 in 2019 to 120,000 in 2020.

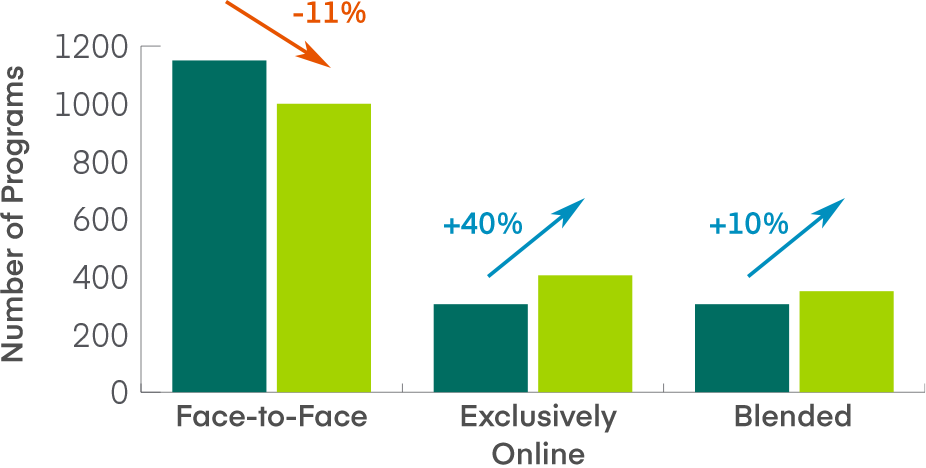

Even more tellingly, IPEDS data show that more than half of the institutions with MBA programs offer some form of those programs online. Institutions with online programs have grown more than those without online MBAs. Between 2019 and 2020, AACSB recorded increases in 134 MBA programs, none of which were face-to-face. In 2020, 101 fewer face-to-face programs were offered, a result of converting those programs to online formats in some capacity (see Figure 1 below).

The key takeaway from this data: On the eve of the pandemic, schools were already shifting face-to-face programs to online modalities.

Figure 1: The Online/Hybrid MBA Migration Is Well Underway

Source: Everspring analysis of AACSB data

The well-documented move to online or hybrid modalities is a sign of things to come, not only for MBAs but for all fields of study. This is especially true in graduate education, where prospective students are often working adults who put a premium on flexibility.

Finding Stability in a Lopsided Growth Trajectory

For our analysis, we segmented MBA programs into four distinct quartiles based on their 2020–21 enrollments:

- Giant—programs with a range of 420–1,500 enrollments

- Scaled—programs with a range of 225–420 enrollments

- Mid-Sized—programs with a range of 110–220 enrollments

- Room to Grow—programs with fewer than 110 enrollments

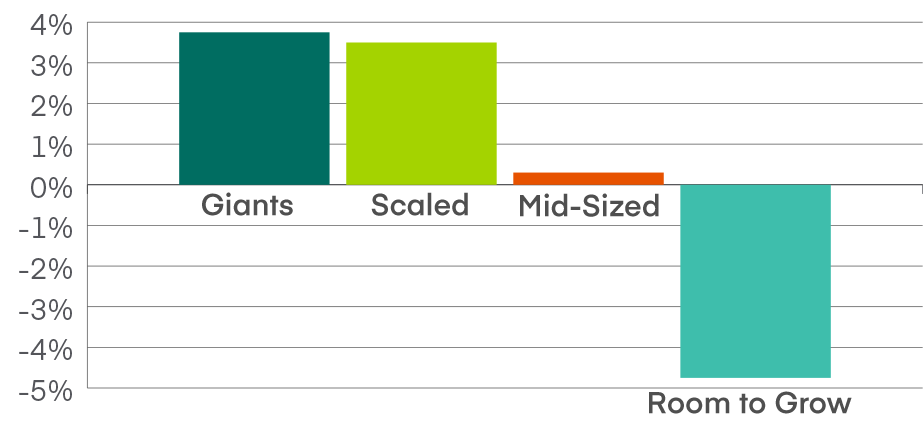

Our analysis showed that between 2016 and 2021, programs in the Room to Grow quartile have been in a continuous state of decline, with enrollments decreasing by a 5.8 percent compound annual growth rate (CAGR). During the onset of COVID in 2020, enrollment declines of Room to Grow programs slowed but persisted.

At the opposite end of the spectrum, we found that programs in the Giant quartile grew over the last five years and after the onset of COVID (see Table 1 below). Programs within the Giant quartile were more likely to be online and at a public institution.

Table 1: Enrollment Trends in the MBA Market

|

Category |

5-Year Enrollment CAGR* 2016–17 to 2020–21 |

% Programs With Positive 5-Year CAGR |

% Growth Through COVID (2020–21) |

% Programs With Positive 2020–21 Growth |

% Reporting Online Options |

% Public Schools |

|

Total Sample (295 Institutions) |

2% |

56% |

11% |

63% |

82% |

73% |

|

Giant (First quartile—top 25% of enrollments—420 to 1,500) |

3.8% |

70% |

12% |

72% |

91% |

80% |

|

Scaled (Second quartile—225 to 420) |

3.5% |

65% |

13% |

70% |

82% |

65% |

|

Mid-Sized (Third quartile—110–220) |

.01% |

48% |

10% |

63% |

78% |

75% |

|

Room to Grow (Fourth quartile—bottom 25% of enrollments—below 110) |

-5.8% |

46% |

-2.7% |

53% |

75% |

73% |

*Compound Annual Growth Rate

One finding not shown in the table above is that COVID appears to have been an enrollment boon for more public institutions than privates, with 70 percent of public institutions in the sample seeing growth between 2020 and 2021. By comparison, only 50 percent of private institutions saw a similar trend. One possible reason for this trend is that the typically lower tuition cost at public institutions was more appealing to students, given the economic uncertainties that came along with COVID.

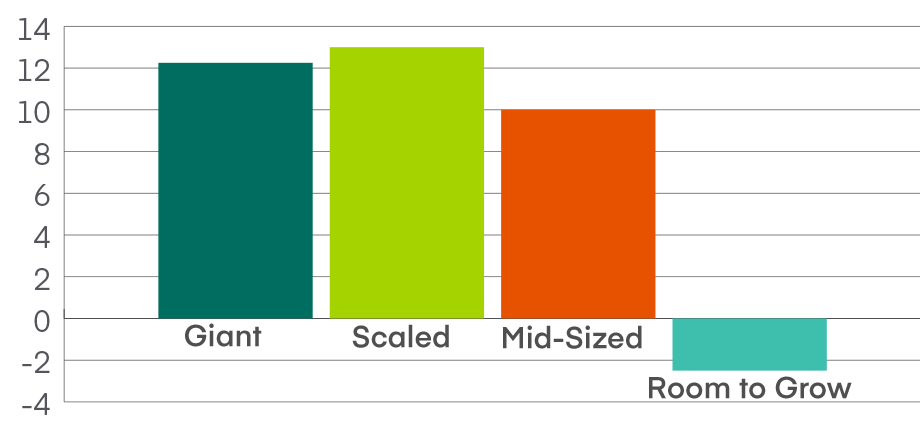

We also found that those programs with the largest numbers of enrolled students were more likely to have increased their enrollments more than the smaller programs. For example, programs in the Giant and Scaled quartiles had a five-year CAGR of 3.8 percent and 3.4 percent, collectively, adding nearly 10,000 students over the last five years. Conversely, the CAGR of programs with less than 110 students collectively shrank by 4.8 percent over that period (see Figure 3 below).

Figure 2: Five-Year CAGR of Enrollments

Source: Everspring analysis of AACSB data

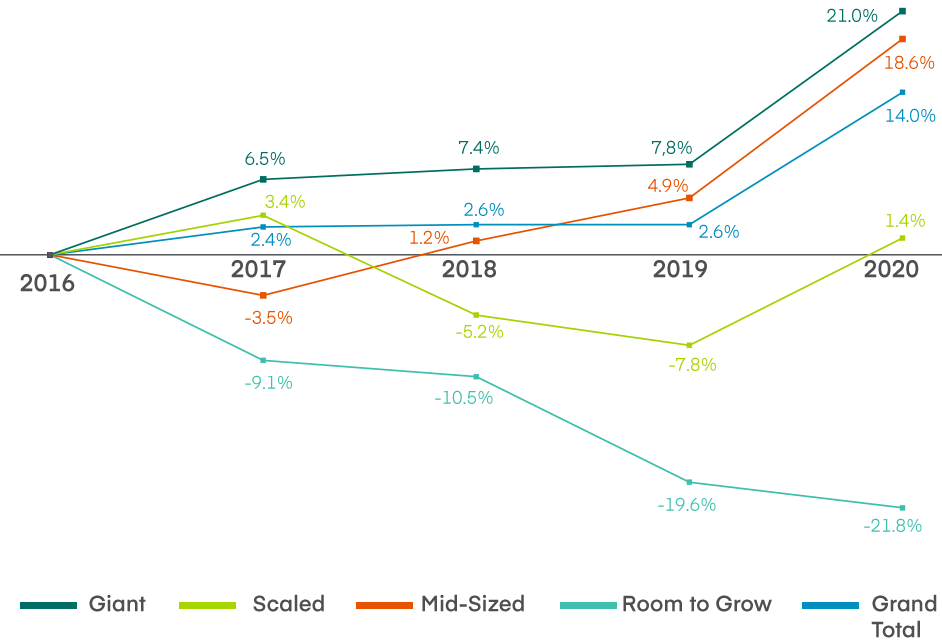

We found similar trends when we compared enrollments in 2019–20 to those in 2020–21. Once again, the largest programs grew the most while the smallest programs shrank (see Figure 4 below).

Figure 3: COVID Impact: Changes in Enrollment From Fall 2020 to Fall 2021

Source: Everspring analysis of AACSB data

Notably, the distribution of growth is different here. Scaled programs grew most, by 13 percent (up 2,700 students). Giant and Mid-Sized programs grew by 12 percent (up 6,000 students) and 10 percent (up 1,000 students), respectively. Only Room to Grow programs declined over this period, enrolling 2.7 percent fewer students compared to the previous year.

Overall, COVID had a positive effect on enrollments. Its impact slowed (but did not reverse) enrollment declines for Room to Grow programs, and it reversed two years of consecutive declines for Mid-Sized programs. Giant and Scaled programs saw year-over-year growth since 2016, although that growth was far from consistent. (See Figure 5 below.)

Figure 4: Change in MBA Enrollments Since 2016

Source: Everspring analysis of AACSB data

Preparing for Post-Pandemic Growth

Over the coming months and years, the enrollment boon that many institutions saw during the pandemic will likely wane. This is an essential data point for academic administrators who must plan to operate in a market that is already hypercompetitive.

However, it is necessary to note that demography is not destiny. Not all Giant programs will realize success as so many had in recent years, nor will all Room to Grow programs necessarily see declines. Instead, any school’s path to success depends on how well it aligns its institutional strategies with the trends and student expectations of its individual regional market.

Given enrollment shifts in recent years, it’s critical for schools to know where they stand in the market and where they have opportunities to grow. Everspring partners with colleges and universities to build hybrid and online courses that deliver high-quality, engaging learning experiences, based on their strengths and aligned with their reputations. We offer administrators at any school a free Market Scan, to help them better position their institution for future growth. To learn more about Everspring, please visit www.everspringpartners.com/contact-us.