Time for Educators to Lead on Societal Impact

- While business has created jobs and lifted nations out of poverty, it has caused harm to individuals and environments.

- Concepts such as conscious capitalism, social entrepreneurship, and the triple bottom line have moved business toward becoming a force for good.

- Business schools need to stop teaching shareholder primacy and train students to become leaders committed to positive societal impact.

There has been a lot of discourse lately on the role of Milton Friedman in channeling business thinking to focus solely on creating shareholder wealth. On the positive side, this focus has facilitated a great deal of investment capital, technology development, new business, and employment opportunities. Business has lifted people and nations out of poverty and into viable standards of living. It has contributed to a steady rise in GDP for the U.S. and most other countries.

Yet, the theory of profit maximization frequently has caused harm to the environment, employees, customers, suppliers, and the community. For instance, to improve profits, firms have let pollutants run into the streams, walked away from devastated land after extracting its resources, ignored or hidden product defects, let unprotected employees work in unhealthy environments, taken advantage of consumer vulnerabilities, and demanded unending price cuts from suppliers. All too often a firm will justify one of these actions by saying, “It’s just business.”

A related argument is that businesses should not be expected to do good things for the community. Shareholders may share their wealth if they wish, but the job of the business is to create the wealth and pass it on to the owners. This argument overlooks the real problem. Firms often make money by externalizing their expenses, which means that customers, neighborhoods, communities, employees, supply chains, and the environment must pay the bill. The wealth that shareholders enjoy might very well belong to those who have paid the costs for the company’s success.

One reason the Friedman Doctrine is so widely accepted is that business professors have praised its tenets for generations. Until recently, every business professor in every class repeated the same refrain: “The only purpose of business is to create shareholder wealth.” After hearing this litany often enough, even a young idealist eventually will succumb—and potentially become part of the problem. The two of us are both business professors, and we acknowledge that we have perpetuated the harm by touting the theory of profit maximization for decades.

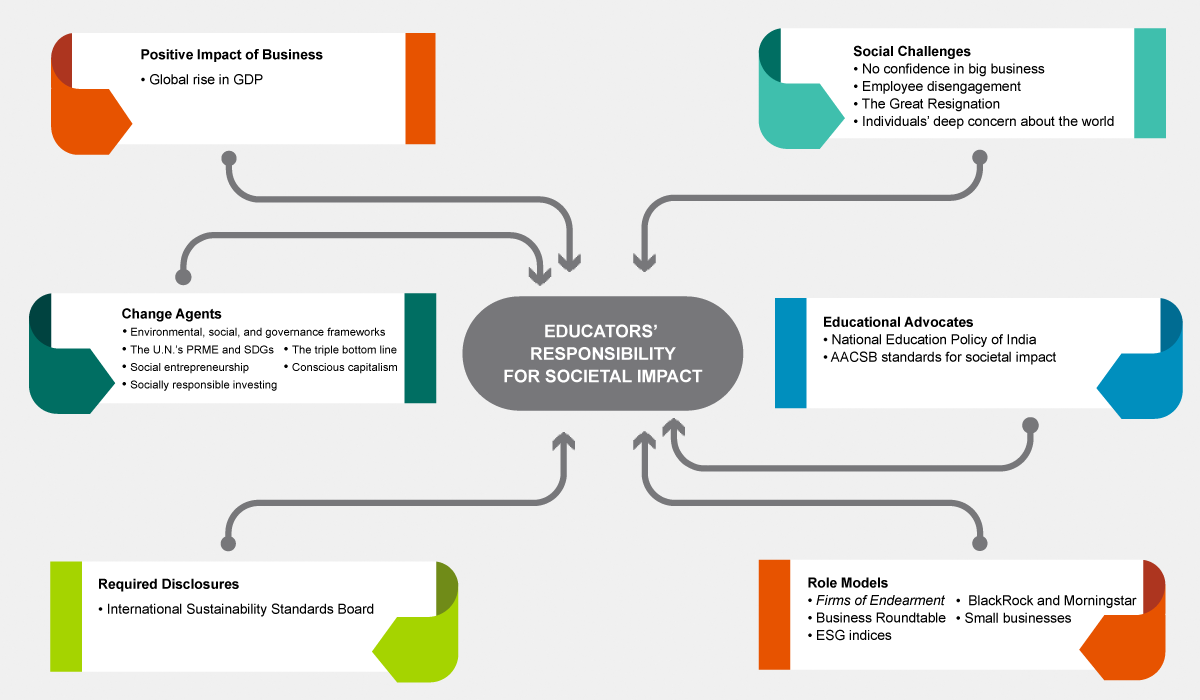

Was Milton Friedman wrong? Is it time to stop declaring that the sole purpose of business is to create wealth for shareholders? We have identified five macroenvironmental forces that are combining to drive business away from the Friedman Doctrine and closer to the model of business as a force for good.

Educators have a responsibility to teach students about the macroeconomic forces that are pressuring businesses and business leaders to manage their societal impact.

We believe that it is time for business educators also to respond to these forces, as we show in the graphic above and explore further in our discussion below. Business faculty must begin shaping the next generation of tomorrow’s leaders to be a positive force in the world through the organizations they will manage.

1. Social Challenges

Despite the great economic benefit of business, Gallup found that confidence in big business has dramatically declined from 34 percent in 1975 to just 14 percent in 2022. At the same time, close to 70 percent of employees at big companies feel disengagement or active disengagement, according to surveys Gallup has conducted since 2000. Along the same lines, research from McKinsey shows that, during 2021 and much of 2022, 40 percent of employees in the U.S. and 60 percent of those in India were planning to leave their jobs.

Why? Current employees want more than compensation and job advancement. They also want caring and inspiring leaders, meaningful work, supportive co-workers, flexible hours, concern for their health and well-being, and safe workplaces.

Gen Z and millennial employees are particularly focused on factors outside of their careers. According to an early 2022 Deloitte survey, these workers “are deeply concerned about the state of the world. They are worried about the cost of living, climate change, wealth inequality, geopolitical conflicts, and the ongoing COVID-19 pandemic, and they are determined to drive positive societal change.”

2. Change Agents

Powerful organizations and social movements have had a huge effect on pressuring business to become more socially responsible. The United Nations has had a particularly significant impact. In 2007, the U.N. Global Compact established the Principles of Responsible Management Education (PRME), which challenged business education to incorporate global social responsibility into its curriculum. Currently, PRME has more than 880 signatory members.

Then, in 2015, the U.N. developed the 17 Sustainable Development Goals (SDGs), which call for business, education, and society to work together to eradicate poverty, improve health and education, reduce inequality, spur economic growth, and preserve nature.

Powerful organizations and social movements have had a huge effect on pressuring business to become more socially responsible. The U.N. has had a particularly significant impact.

Five other notable trends and concepts also have reshaped the way society views the role of business:

- The triple bottom line. Conceived by John Elkington in 1994, this concept highlights the idea that companies should measure their success by their effects on people, planet, and profits. Triple-bottom-line thinking has spurred the creation of more than 400 standards and certification programs—such as B Corp, Green Businesses, and Ecolabels—that are designed to “put ‘good’ ahead of profits in a programmatic way.”

- Conscious capitalism. Founded by Raj Sisodia, the conscious capitalism movement posits that when respected and involved workers treat customers and the community well, stakeholders rally behind businesses, improving reputations, sales, and bottom lines. Sisodia points to the Taj Hotel in Mumbai as one company that fully embraces this concept.

- Social entrepreneurship. As described by John Elkington and Pamela Hartigan in their 2008 book The Power of Unreasonable People, social entrepreneurs seek social output, not financial gain, as their reward.

- Socially responsible investing. SRI is a grassroots phenomenon in which investors support companies that display social impact, ethical corporate behavior, respect for worker rights, and environmental responsibility, while incurring no human rights violations. According to Forbes Advisor, more than 12 trillion USD was invested in SRI assets in the U.S. in 2018.

- Environmental, social, and governance frameworks. Popularized in a 2004 U.N.-backed report titled “Who Cares Wins,” the ESG approach encourages an organization to consider sustainability risks and the well-being of stakeholders as part of its business strategy.

3. Role Models

Not only are change agents rejecting the idea of shareholder primacy, business leaders are also doing so as they voluntarily adopt principles that run counter to the Friedman Doctrine.

In their book Firms of Endearment, Raj Sisodia, David Wolfe, and Jagdish Sheth profiled more than 60 firms that chose to be socially responsible—and outperformed the S&P 500 by 14 times. The 181 American CEOs in the Business Roundtable adopted a new Statement on the Purpose of a Corporation in 2019, declaring that companies should not only serve shareholders, but also “deliver value to their customers, invest in employees, deal fairly with suppliers and support the communities in which they operate.”

Individual companies also are leading the way. Both asset manager BlackRock and investment firm Morningstar have their own ESG divisions, and Morningstar annually reports on 116 indices that evaluate companies on ESG criteria. Some shareholders fear that ESG investing requires a financial sacrifice, but a February 2022 report from Morningstar concluded that while ESG investments might not beat the market, they can provide “stellar” protection from economic downturns and produce competitive returns.

4. Required Disclosures

The commitment of firms like BlackRock and Morningstar underscores how important it is for companies to manage their societal impact—and regulators have started to agree. In 2021–22, the International Financial Reporting Foundation set up the International Sustainability Standards Board (ISSB) to develop sustainability-related financial reporting standards. These will become part of IFR Standards, which are “accounting rules for the financial statements of public companies that are intended to make them consistent, transparent, and easily comparable around the world.”

Not everyone embraces the idea that management of a firm’s societal impact is good for business. Some state leaders, investors, and CEOs do not want regulators to require ESG measurements, because they want to remain free to do whatever is required to maximize shareholder wealth. Nonetheless, as reported in The New York Times in September 2022, more than 90 percent of companies in the S&P 500 now publish ESG reports. The article quotes a letter BlackRock CEO Larry Fink wrote to investors, in which he declares that “Stakeholder capitalism … is capitalism, driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper.”

5. Educational Advocates

A focus on sustainable business is also on the rise because the concept is being introduced in more classrooms. For instance, in 2020, India instituted the National Education Policy Act, which encourages learners to develop skills and values that “support responsible commitment to human rights, sustainable development and living, and global well-being.”

AACSB advocates for its member schools to focus on business’s role in the world, and schools are now including societal impact provisions in their mission statements.

AACSB also advocates for its member schools to focus on business’s role in the world. Not only has the organization contributed to the U.N. Global Compact and PRME, it implemented new accreditation standards in 2020 that include this statement of intent: The vision of AACSB International is to transform business education globally for positive societal impact.

Schools are now including societal impact provisions in their mission statements, and educational tools such as business simulations are available to help educators introduce concepts of responsible business to the classroom.

Change Is Coming

Combined, these forces are pushing us to an obvious conclusion: Business must do more than create wealth for owners and shareholders. It must be responsible to society. But if business is going to change, three things must happen:

First, businesses must commit to doing no harm. If a company focuses on the triple bottom line and incorporates ESG principles, it can measure its actual costs without externalizing them to employees, communities, or supply chains. Embracing ESG protects stakeholders, encourages positive actions, and results in market returns that are consistent with other investments.

Second, companies must engage with stakeholders. When businesses were smaller and senior executives lived in the community, it was so much easier for owners and managers to understand how employees and neighborhoods were affected by the decisions of the business. “Business and community were two peas in a pod, mutually coexisting and nurturing each other,” writes Jagdish Sheth in a 2020 article in Industrial Marketing Management.

Small businesses still maintain that involvement—and are rewarded for it. While employee engagement at big companies has hovered at 14 percent in recent years, according to Gallup, it’s been near 70 percent for small business. Even big companies can reap the rewards of higher engagement if they pour resources into workers and communities.

Third, business education must transform. We must begin teaching our students about all the forces listed above: the social challenges, change agents, and the new educational policies. We must provide students with examples of companies that do good and explain why transparent reporting is necessary for business and the world. We need to help them realize that they too can make a difference and become role models for society.

The pressure is growing for businesses to offset the harm they do and to make a positive impact instead. But none of this pressure has been inspired by the Friedman Doctrine.

Perhaps there is room for a revised Friedman Doctrine: The purpose of business is to maximize shareholder wealth—provided the business has paid its full share of the costs incurred, pursued stakeholder opportunities that yield mutual gain, and taken the initiative to be a force for good in society.

Or perhaps there is no need for the Friedman Doctrine at all. For certain, it is time for educators to take the lead on shaping the societal impact of business.