The Importance of Variance Analysis

This critical topic is too often taught to only a handful of students—or neglected in the b-school curriculum altogether.

Variance analysis is an essential tool for business graduates to have in their toolkits as they enter the workforce. Over our decades of experience in executive education, we’ve observed that managers across all industries and functions use variance analysis to measure the ability of their organizations to meet their commitments.

Because variance analysis is such a powerful risk management tool, there is a strong case for including it in the finance portion of any MBA curriculum. Yet fewer than half of finance professors believe they should be teaching this subject; they view it as a topic more typically taught in accounting classes. At the same time, in practice, variance analysis is such a cross-functional tool that it could be taught throughout the business school curriculum—but it’s not. We perceive a worrisome disconnect between the way variance analysis is taught and the way it is used in real life.

Variance Analysis and Its Applications

There are three periods in the life of a business plan: prior period to plan, plan to actual, and prior period to actual. For instance, if a business plan is being formulated for 2019, the “prior period” would be 2018, the “plan to actual” would be the budget for 2019, and the “prior period to actual” would be what really happens in 2019. These three stages are also referred to as planning, meeting commitments, and growth.

For each of these periods, variance analysis looks at the deviations between the targeted objective and the actual outcome. The most common variances are found in price, volume, cost, and productivity. When executives conduct an operational review, they will need to explain why there were positive or negative variances in any of these areas. For instance, did the company miss a target because it lost an anticipated national account or failed to lock in a price contract due to competitive pressure?

Executives who understand variances will improve their risk management, make better decisions, and be more likely to meet commitments. In the process, they’ll produce outcomes that can give an organization a real competitive advantage and, ultimately, create shareholder value.

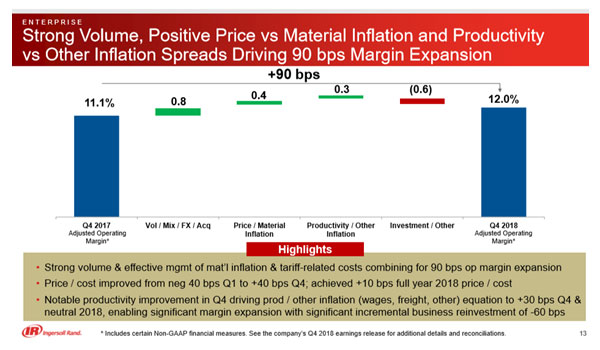

Most businesses apply variance analysis at the operating income level to determine what they projected and what they achieved. The variances usually are displayed in the form of floating bar charts—also known as walk, bridge, or waterfall charts. These graphics are often used in internal corporate documents as well as in investor-facing documents such as quarterly earnings presentations.

While variance analysis can be applied in many functional areas, it is used most often in finance-related fields. Yet, the majority of finance programs at both the graduate and undergraduate levels don’t cover it at all. We surveyed finance faculty in 2013 and accounting faculty in 2017 to determine how they teach and use variance analysis. Among other things, we learned that:

- More than 80 percent of accounting faculty believe that variance analysis is important to a finance career, and they are far more likely to teach it than their finance faculty colleagues.

- Only 59 percent of finance faculty and 48 percent of accounting faculty are familiar with examples of walk charts from real-world companies. Yet these visual portrayals of operating margin variances are commonplace in quarterly earnings presentations and readily found on investor relations websites.

Because universities mostly fail to teach this important topic, corporate educators have been left to fill the learning gap. Many global organizations, in fact, make variance analysis a key subject in their development programs for entry-level financial professionals.

The University Response

We believe it’s critical for universities to better align their curricula with the skills that today’s employers seek in the graduates they hire. Not only do we think variance analysis should be included in the business curriculum, but we could even make an argument for running it as a capstone business course. We offer these suggestions for ways that faculty could integrate this powerful tool across the business school program:

- Both accounting and finance faculty should, as much as is practical, incorporate variance analysis into their classes, particularly focusing on financial planning and analysis. We acknowledge that a dearth of corporate finance texts on the topic will make this a challenge for finance professors. The two of us employ teaching materials in our graduate business and undergraduate finance classes based on experience in the corporate world, and we would be glad to share them with others.

- Faculty who use case studies should always include a case specific to variance analysis tools. Students who pursue careers in corporate finance will almost certainly be required to use such tools, particularly as data and predictive analytics applications are enhanced to improve forecasting accuracy. Two sources of such case studies are TRI Corporation and Harvard Business Publishing.

- Professors can introduce students to real-world applications of variance analysis by showing how it is used in investor relations (IR) pitches. As instructors, the two of us routinely search IR sites for applications of variance analysis. We specifically look for operating margin variance walks (floating bars, brick charts) for visual applications that can make the topic come to life for students. Here’s an example from Ingersoll Rand:

- Faculty from accounting and finance programs should collaborate on when, where, and how to teach variance analysis. At the very least, this will ensure that students gain an understanding of the topic from either a finance or an accounting perspective, but the ideal would be for them to benefit from both perspectives for a holistic understanding. At Fairfield University, accounting programs introduce students to the theory of variance analysis. Then finance programs take an operational and cross-functional approach that addresses planning, meeting commitments, and growth.

- Both accounting and finance faculty should help finance majors understand variance analysis from a practitioner’s standpoint. Discussions about pricing, supply chain, manufacturing costs, risk management, and inflation and deflation around cost inputs can help students grasp the necessity of making trade-offs and balancing short-term and long-term business goals. To make sure students understand the practitioner’s viewpoint, we use corporate business simulations that are more operationally focused, as opposed to being academic in tone.

- To extend the topic to all majors, not just finance and accounting students, faculty from disciplines such as strategy and operations could also incorporate variance analysis into their classes. For instance, if they use business simulations for their capstone courses, they could add a component that covers variance analysis. At Fairfield, we use a variety of competitive business simulations from the corporate world.

- Finally, professors can bring in guest speakers from almost any business functional area and ask them to explain, as part of their presentations, how variance analysis is relevant in their fields. As an example, we often have senior finance executives from Stanley Black & Decker—a company known well-known for its ability to grow and meet its commitments via variance analysis—present to our graduate program. We tap other companies from Fairfield County as well.

In the graduate classes we teach at Fairfield University, we have always tried to connect theory with practice. And we’ve long believed that creating a culture of meeting and exceeding commitments requires aligning interaction across functions in the workplace. With this article, we hope that, at the very least, we can start a larger discussion about the need for cross-disciplinary teaching of variance analysis.

For more about variance analysis materials, contact us at [email protected] or [email protected].