2017–18 BSQ Finances Module: A Look at Business School Fundraising Practices

Five years ago, AACSB extracted the majority of the financial data points collected in its annual Business School Questionnaire (BSQ) into a separate survey module, while enhancing them with a complementary set of questions about business school governance and compensation practices. The result of this decision was a new data collection instrument, the BSQ Finances Module, which has since run concurrently with the BSQ each year.

Among the new areas addressed in the BSQ Finances Module were some of the most often-asked-for data points that AACSB had not previously been collecting in the larger survey, in particular, data on business school fundraising. With this and other changes, the new Finances Module is now oriented to serve the popular demand among AACSB members for a more comprehensive resource on the financial operations and strategies of AACSB business schools, so they can benchmark themselves against their peers.

The BSQ Finances Module yields insights on fundraising by identifying the relative contribution (percentages) of the total private gift and grant amounts reported by the business school, both for capital purposes and for current operations. Capital donations include those made for equipment, buildings, loan funds, and endowments. Donations for current operations are further subdivided by those whose donors specify the use for which the donation is intended (Current Operations: Restricted), versus those whose donors do not specify a certain use (Current Operations: Unrestricted). Donor types include individuals (broken out by alumni versus non-alumni when possible), private charitable organizations or foundations, publicly funded foundations or government agencies, and for-profit corporations.

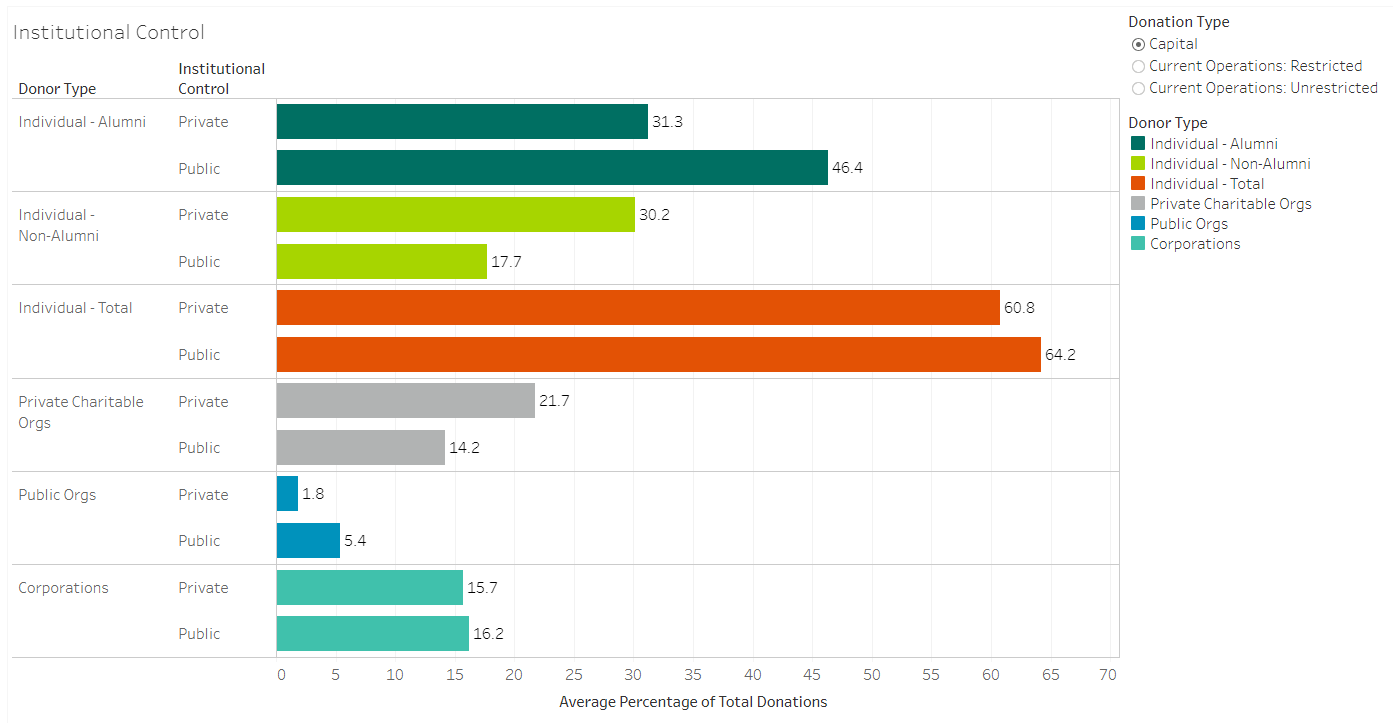

Figure 1. Mean Percentage of Total Donations by Donor Type and Institutional Control

Source: 2017–18 BSQ Finances Module. Note: Not all schools were able to break individual donors down into alumni versus non-alumni, and in this case reported only the total.

In analyzing results from this year’s survey, it is clear that the institutional control (public versus private) of the reporting schools varies noticeably in relation to the different percentages by donor type, particularly for capital donations. What is particularly notable is that, on average, individual donors giving capital donations to public schools are much more likely to be alumni of the school, whereas at private schools, both alumni and non-alumni individuals are about equally likely to give capital donations.

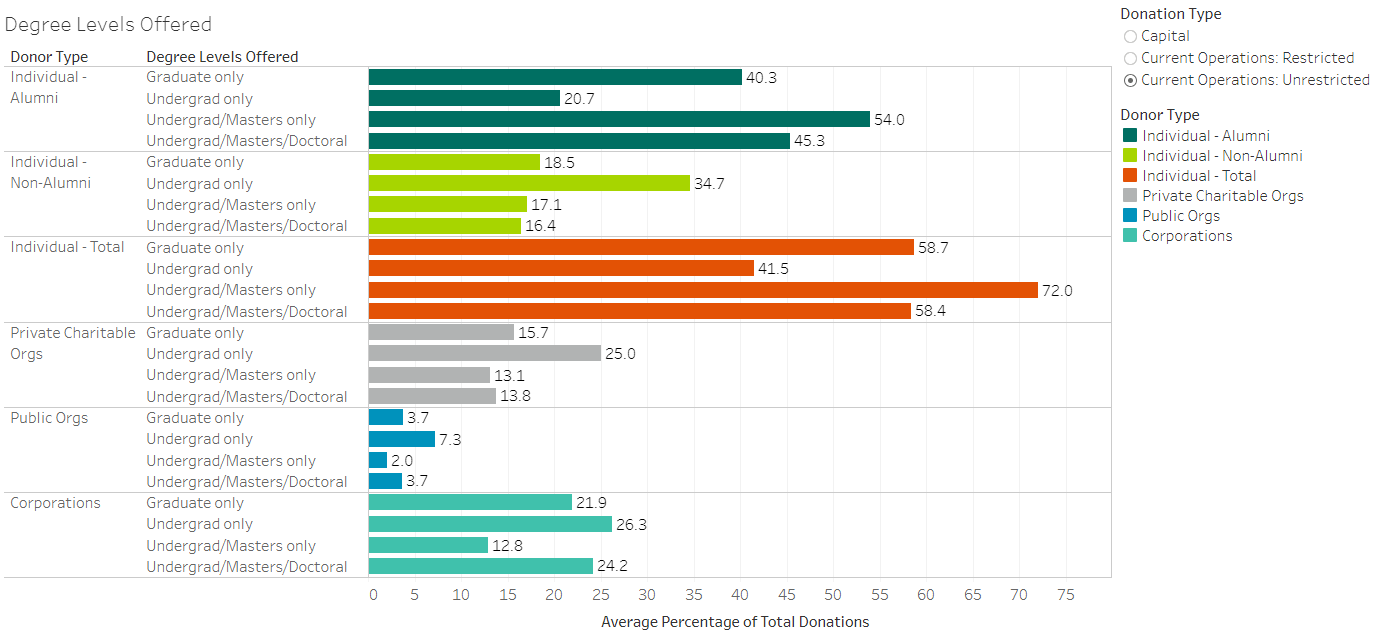

Figure 2. Mean Percentage of Total Donations by Donor Type and Degree Levels Offered

Source: 2017–18 BSQ Finances Module. Note: Not all schools were able to break individual donors down into alumni versus non-alumni, and in this case reported only the total.

The degree levels offered by reporting schools is another factor where the average percentage of total donations by donor types is considerably different. Participating schools that offer only graduate-level degrees, for example, are the only ones that seem likely to receive an overall greater share of individual capital donations from non-alumni than from alumni. Where unrestricted donations for current operations are concerned, however, the schools offering only undergraduate degrees are the ones likely to receive the larger share.

Because we collect the fundraising data in the form of percentages of total amounts, these data are attributable to specific schools when running benchmarking reports in the DataDirect system. AACSB member schools that participated in the 2017–18 BSQ Finances Module can now access these and many other data on the finances and governance practices of business schools, which they can use to compare themselves against peers and other schools within their defined markets.

For questions on participating in surveys or using DataDirect, please contact us at [email protected].